Double Taxation Agreements

Double taxation is a tax principle referring to income taxes paid twice on the same source of income. It can occurs when income is taxed at both the corporate level and personal level; and in international trade or investment when the same income is taxed in two different countries. It mainly occurs because corporations are considered separate legal entities from their shareholders. As such, corporations pay taxes on their annual earnings, just like individuals. When corporations pay out dividends to shareholders, those dividend payments incur income-tax liabilities for the shareholders who receive them, even though the earnings that provided the cash to pay the dividends were already taxed at the corporate level

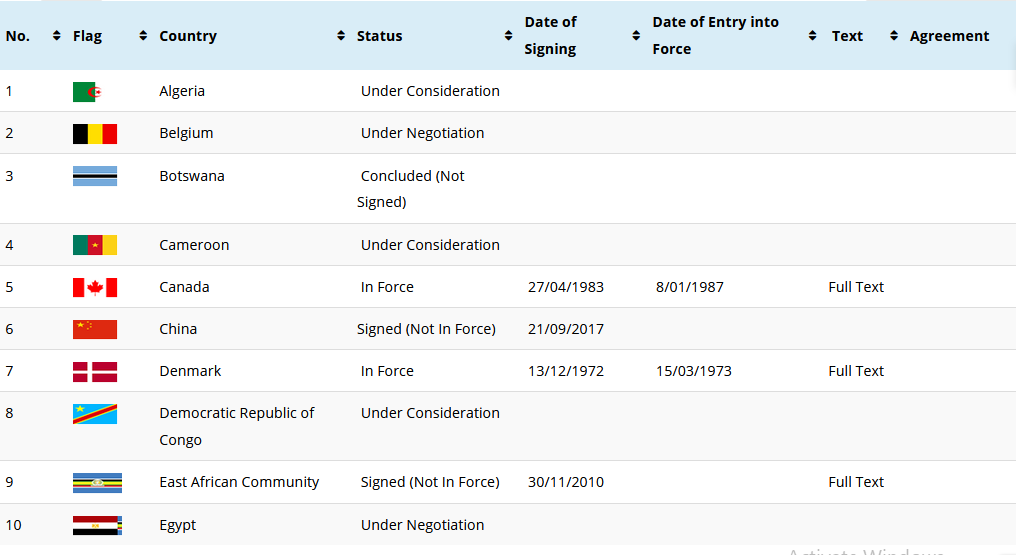

Double taxation is often an unintended consequence of tax legislation. It is generally seen as a negative element of a tax system, and tax authorities attempt to avoid it whenever possible. A key method authorities use to address double taxation problem is through Double Taxation Agreements (DTAs). DTAs are international agreements between two countries to allocate taxing rights between the two countries that have negotiated the particular DTA. The purpose a DTA is to help the two countries to avoid double taxation. Kenya mainly uses DTAs to avoid double taxation at international level.

For more information kindly download…

Proposed Kenya-Botswana Double Taxation Agreement

East African Community Double Taxation Agreement

Kenya Canada Double Taxation Agreement

Kenya Denmark Double Taxation Agreement

Kenya France Double Taxation Agreement

Kenya India Double Taxation Agreement

Kenya Iran Double Taxation Agreement

Kenya Kuwait Double Taxation Agreement

Kenya Mauritius Double Taxation Agreement

Kenya Netherlands Double Taxation Agreement

Kenya Norway Double Taxation Agreement

Kenya Seychelles Double Taxation Agreement

Kenya South Africa Double Taxation Agreement

Kenya Sweden Double Taxation Agreement

Kenya United Arab Emirates Double Taxation Agreement

Kenya United Kingdom Double Taxation Agreement

Kenya Zambia Double Taxation Agreement

Legal Notice No. 147 india Double Taxation Agreement

Proposed Kenya – Turkey Avoidance of Double Taxation Agreement